Special Education Directors know better than anyone—compliance matters. However, school-based Medicaid billing errors often slip through, not only preventing your district from adhering to state and federal regulations but also causing missed reimbursements your district qualifies for. That reimbursement is crucial for covering student needs that might otherwise go underfunded.

Standards for documentation submission in school-based Medicaid billing vary by state but generally follow federal guidelines set by the Centers for Medicare & Medicaid Services (CMS). Having the guidance and support of a qualified team that stays up to date with both state and federal Medicaid billing regulations can help ensure compliance and prevent billing errors.

We’ve compiled a list of six common school-based Medicaid billing mistakes to avoid in 2025. This article highlights the most frequent issues our Medicaid Success Team has identified over 20 years of assisting EmbraceDS® Medicaid Billing software customers across Illinois, Utah, Washington, and Texas.

1. Incorrect Documentation

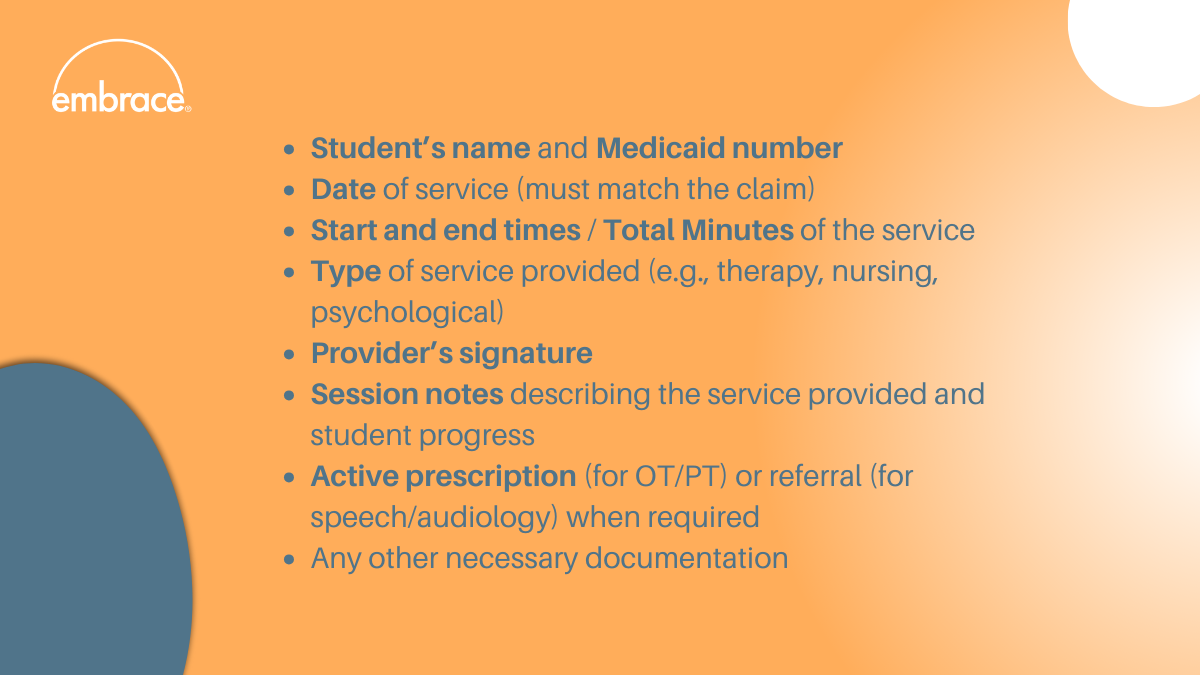

Lack of proper Medicaid documentation can result in owing money back to the state during an audit review. The completeness of records also matters. To avoid these mistakes, ensure you collect detailed paperwork for all services provided. Typically, each billed service must include:

When using EmbraceDS® Medicaid Billing software the requirements above are verified before claim submission. If any requirement is missing or incomplete, Embrace® notifies the district and holds the claim in a queue until the Medicaid billing error is resolved.

Failure to link services to the Individualized Education Plan (IEP) can also result in compliance issues. Services billed must be medically necessary and explicitly listed in the IEP to support the claim. The IEP must specify the type, frequency, and duration of services. If the services provided do not align with what is outlined in the IEP, improper billing could result in funds being owed back to the state.

2. Not maintaining consent forms

Districts may only bill a child's or parent's public benefits or insurance program for Medicaid reimbursement starting from the date the parent signs the consent form and for services provided thereafter.

Therefore, before billing Medicaid, obtaining parental consent is recommended to ensure compliance. If the consent form is missing, claims should not be submitted for reimbursement.

When working in EmbraceDS®, you can enter claims for services delivered, but we will only submit claims for services provided on or after the date the consent was signed. Here are a few other Embrace® Medicaid billing requirements that help ensure compliance:

3. Inconsistent or improper claim submissions

Many states require claims to be submitted within 12 months, or less, of the service date. However, instead of waiting to submit claims monthly or quarterly, documenting in real-time or on a weekly basis can significantly improve accuracy and reduce stress for you and your staff as submission deadlines approach.

“Time is of the essence when it comes to service delivery and then documenting that service,” says Stephanie Crouch, Medicaid Success Manager at Embrace®. “One of the takeaways discussed at the NAME conference was that districts (Directors/Superintendents) should be building in time in the providers' schedules for service documentation.”

Stephanie’s key recommendation to directors is to help their staff with time management and build documentation time into providers’ schedules. “There just aren't enough hours in the day and providers, a lot of the time, utilize their personal time for service data entry. If districts really strive for that interim reimbursement, Directors should consider building in that documentation time for providers (i.e. an hour or two a week). In EmbraceDS®, it takes providers minimal time to document their weekly services for students.”

Waiting until the last moment can often lead to late submissions. Additionally, submitting claims after the required deadlines results in denials. Claims must fall within the timely filing window for School-Based Health Services to be submitted to the state for reimbursement. Each state has its own timeframe for submitting claims, though. For instance, in Illinois (IL), timely filing for schools is 180 days from the date of service. If you’re unsure about the deadlines and you’re an EmbraceDS® customer, our Medicaid Success team will keep you updated via email.

4. Unqualified personnel

When providers fail to meet state licensure and certification requirements, districts may inadvertently bill for non-certified providers. However, Medicaid only reimburses for services provided by qualified personnel.

For instance, if an aide or paraprofessional provides a service that requires a licensed professional (e.g., speech therapy by a licensed speech pathologist), the claim(s) should be reviewed and cosigned by the appropriate licensed therapist before submission.

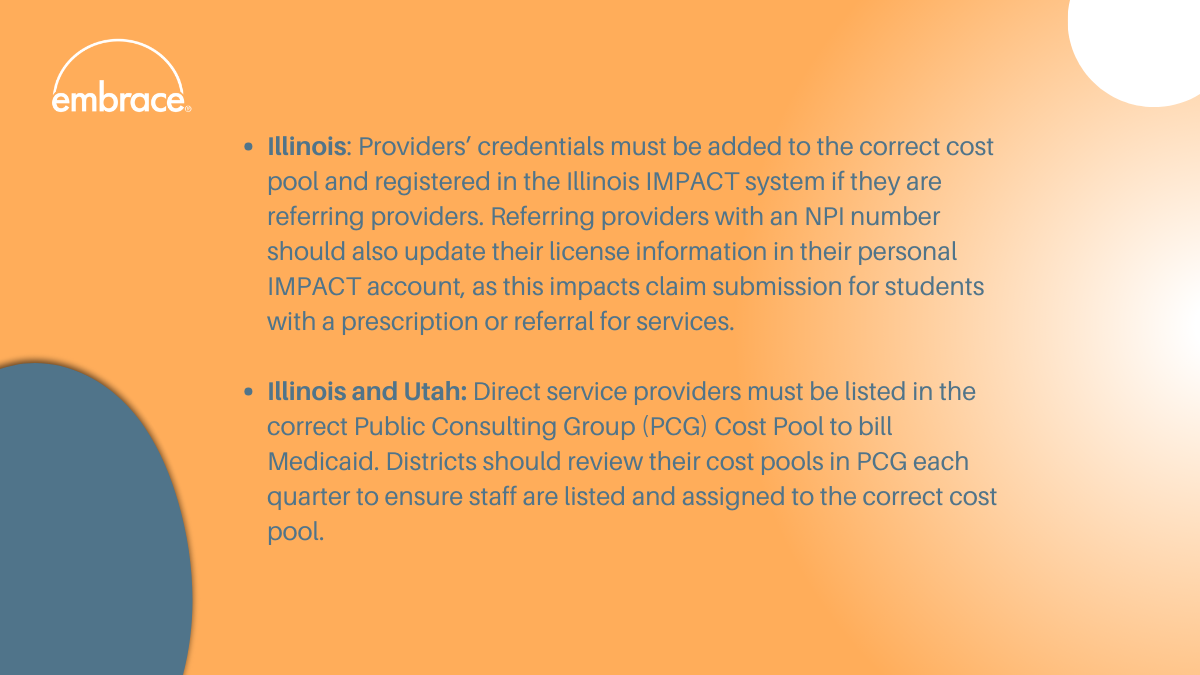

It is the district’s responsibility to verify and maintain documentation ensuring that service providers are properly licensed and credentialed. Districts should verify annually—and as needed—that their providers are fully licensed, have no disbarments, and renew their licenses by the designated due dates to prevent lapses in coverage. These requirements may vary by state. For example:

5. Failure to answer Random Moment Time Study (RMTS) emails

The RMTS is the federally accepted method of documenting the amount of staff time spent on direct service and administrative outreach activities.

RMTS is completed through PCG and is essential for obtaining Medicaid administrative outreach reimbursement—and ultimately fee-for-service reimbursement. Therefore, failure to answer RMTS emails can lead to compliance issues.

Districts should ensure that staff respond to all RMTS emails in a timely manner, as they must meet a minimum time study response rate of 85%. Failure to respond to emails impacts the overall state percentage of time spent delivering direct medical services, which is used to calculate the Medicaid allowable costs for cost settlement.

6. Not following Medicaid guidelines

Districts often overlook the fact that Medicaid does not reimburse for all services. For example, administrative costs, parent contact, and IEP meetings (such as case management or transportation) may not be reimbursable unless specifically authorized. As an EmbraceDS® customer, you can always reach out to our Medicaid Success team via chat, email, or phone to quickly clarify these details.

Additionally, using incorrect ICD-10 diagnostic codes or procedure codes can lead to claim rejections. Each service must have the appropriate code associated with it to ensure payment. In our Embrace® knowledge base, available to all EmbraceDS® customers, you can check the up-to-date list of Medicaid Billing Service Codes in different states.

To avoid the Medicaid billing errors we’ve listed above, our team recommends:

- Training: Ensure that all staff involved in billing and documentation understand the requirements and have access to ongoing training. At Embrace®, in addition to the initial training you and your staff receive upon software acquisition, we also offer mid-year refresher training at no additional cost.

- Researching state-specific requirements: Stay updated on any changes to Medicaid billing requirements in your state. As an EmbraceDS® customer, you’ll receive regular email updates from our team on any updates in regulations at both the federal and state levels.

- Using Medicaid billing software paired with personal assistance from a dedicated Medicaid Success team: With EmbraceDS®, you receive the full attention and immediate assistance of our Medicaid team at no additional cost.